New survey outlines network infrastructure challenges and priorities for video game companies

Imagine venues filled with passionate cheering fans, and hundreds more tuned in via the Internet, plus advertisers filling screen time with their branding. The MLB World Series? The Olympics? Close, but this scenario could actually be describing any one of the hundreds of gaming and esports tournaments occurring globally across the web, and once again in-person, with more taking place each year.

Think esports is just video games? Most analysts value the industry at around $1 billion-plus, with reports commonly estimating it to far surpass that total in the near future due to rapid growth in spectators and sponsorships. Gaming and esports has rapidly evolved from occupying a niche corner of the internet into a full-fledged mainstream form of entertainment.

The industry’s growth is anchored by a critical foundation of higher broadband speeds and penetration, the explosion of live streaming and the increase of video games published with better multiplayer competitive mechanics. In addition, the maturation of gaming and esports can also be traced to a “perfect storm” of market dynamics, including:

- The creativity of game publishers and esports organizations in terms of developing and hosting unique experiences and actively engaging with fans to grow the audience for their content.

- Growing interest from sponsors, advertisers and rights-holders, as esports leagues and tournaments began finding new homes online and on television.

- The COVID pandemic, which accelerated the growth that had already been occurring for the past several years. With games in traditional sports leagues cancelled, this left a void to be filled by gaming and esports, which were perfectly suited to internet-only participation while keeping fans connected and engaged.

These converging trends have led to a heightened focus on enhanced, stable and reliable network connectivity. Since gaming, especially online gaming, is all about the experience, then the connection is everything. A strong and secure network not only helps to create the best user experience possible with the least latency, but it also can ensure fair play and game performance for both amateur and professional gamers.

Finally, the days of hosting gaming tournaments through basic group-chatting platforms or livestreaming through Web browsers and users’ computers are long gone. Now, higher-quality platforms are essential to meet the expectations of larger audiences, advertisers and rights-holders, and further establish gaming and esports as credible and viable industries.

Surveying the landscape

Telstra and Pulse recently surveyed 100 technology leaders at gaming organizations to determine their top network infrastructure challenges, and to identify how telecom providers can help them adapt and grow for long-term success.

Some of the findings fell completely in line with larger industry trends, while others shone a spotlight on disconnects between end users and the companies providing the gaming experiences. These gaps present opportunities to educate all of us in the industry on what the market really needs. They also create business- and relationship-building opportunities for gaming organizations and telecom providers.

Technology leaders at gaming companies are prioritizing the development of their network infrastructure, with well more than half surveyed (62%) noting a partnership with a global telecom provider to achieve their technology goals.

These potential relationships – as well as the challenges and opportunities – have always been there. Now we’re seeing the trends shift towards far greater partnership between telcos and developers. Putting the numbers into context shows an increased desire on the part of gaming companies to expand into international markets, improve the speed and deliverability of their games and establish new platforms such as a move to cloud gaming. This increased level of activity falls under the overarching goal of delivering optimal gaming experiences worldwide for fans, leagues and partners.

Not meeting people where they are?

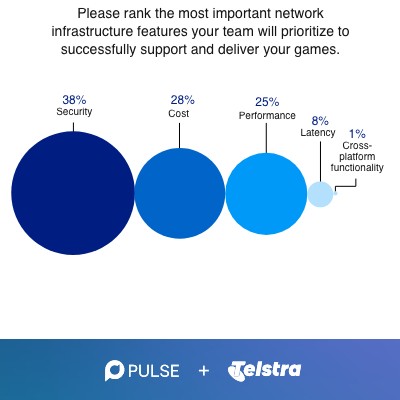

In developing their network infrastructure, the report noted technology leaders and their teams are prioritizing security (38%), cost (28%), and performance (25%) as the most important features, with latency ranking at 8%.

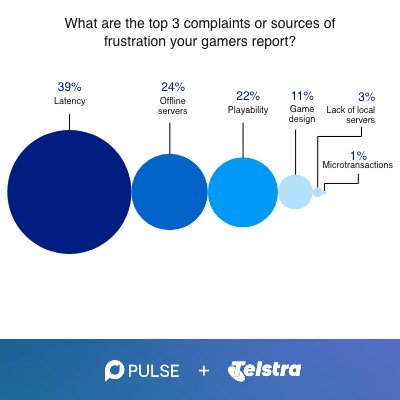

Interestingly, while latency is only the fourth-highest network infrastructure priority for gaming organisations, it’s the top complaint cited by gamers today (39%), followed by offline servers (24%) and playability (22%).

This highlights a potential disconnect between what gaming companies think is important, and what gamers know they need – and can lead to losses all around, in terms of opportunity and growth. Developers and publishers may want to consider this when deciding how to invest in their networks to help match their priorities with what customers want – which will, in turn, boost the user experience.

This potential disconnect can also lead to another worst-case scenario: handling (or rather, mishandling) significant spikes in user traffic during key events.

Tech leaders at gaming companies experience many technology challenges both when developing and launching a game. The cost of connectivity is a challenge for all gaming organisations, with the majority (89%) experiencing this issue during game launch. The most common challenge experienced when developing a game was data leaks (42%).

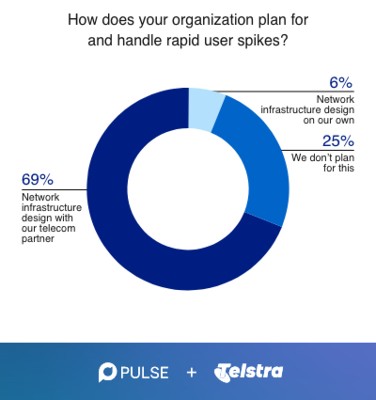

But, with most challenges arising during game launch, it was surprising that 25% of tech leaders admit their organisation doesn’t plan for handling rapid user spikes. It is an enormous risk that a quarter of games may not be able to deal with more uptake than is planned, especially considering the importance of the first few days following a game’s launch for building an audience.

The benefits of working with the right telecom partner

While more than two-thirds (69%) of gaming companies plan to address this through partnership with their telecom partner, there’s still a lot that gaming businesses can do to make the most of the opportunity. Of the organisations currently partnered with a global telecom provider, the most significant benefits they derive are faster, more reliable connectivity (49%) and a simplified network by partnering with the same provider in all or most regions (43%).

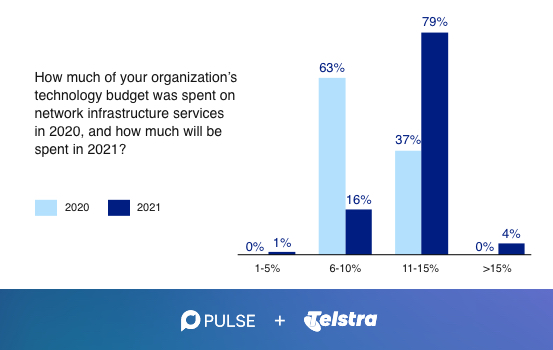

In 2020, most gaming organisations (63%) spent between 6 and 10% of their overall technology budget on network infrastructure services. In 2021, more than three-quarters (79%) will spend 11% or more of their tech budget on these services.

Where’s growth? Everywhere

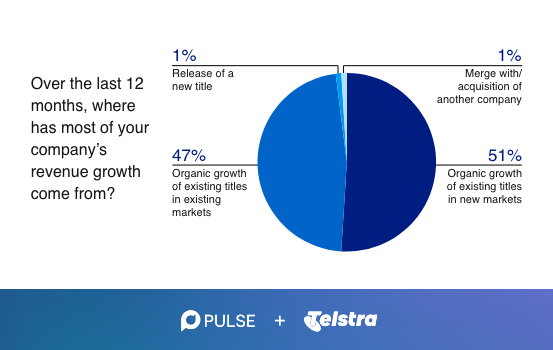

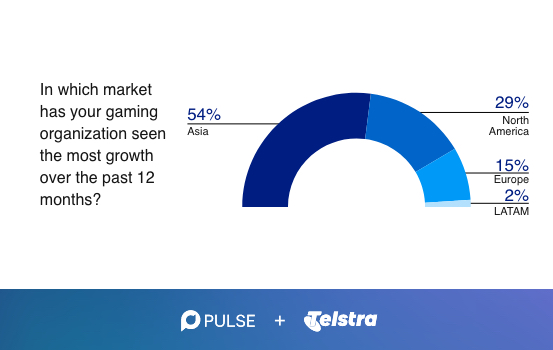

Network connectivity and infrastructure are also more important as growth is now coming from the global gaming market – primarily Asian markets - as much as it is domestically. In the past 12 months, more than half of tech leaders (51%) say most of their organic growth came through existing game titles in new markets. And most of those professionals saw the most growth in the Asian market (54%).

Tech leaders at gaming organisations located in North America are more motivated to partner with a global telecom provider for the purpose of accessing new international markets (30%) than those located in APAC are (19%). Additionally, tech leaders at organisations in APAC (45%) consider the guidance about network needs and infrastructure that they can get from a global telecom partner as a reason to partner with them, as compared to 25% of respondents whose organisations are in North America.

Telstra already works with the six biggest global gaming companies and helps them connect into and within Asia-Pacific. Ready to chat with one of our experts to learn why?

View all the data from the report and learn about the methodology here, learn more about our global network services here, or download our recent white paper that describes how gaming companies and telecom providers should work together here.